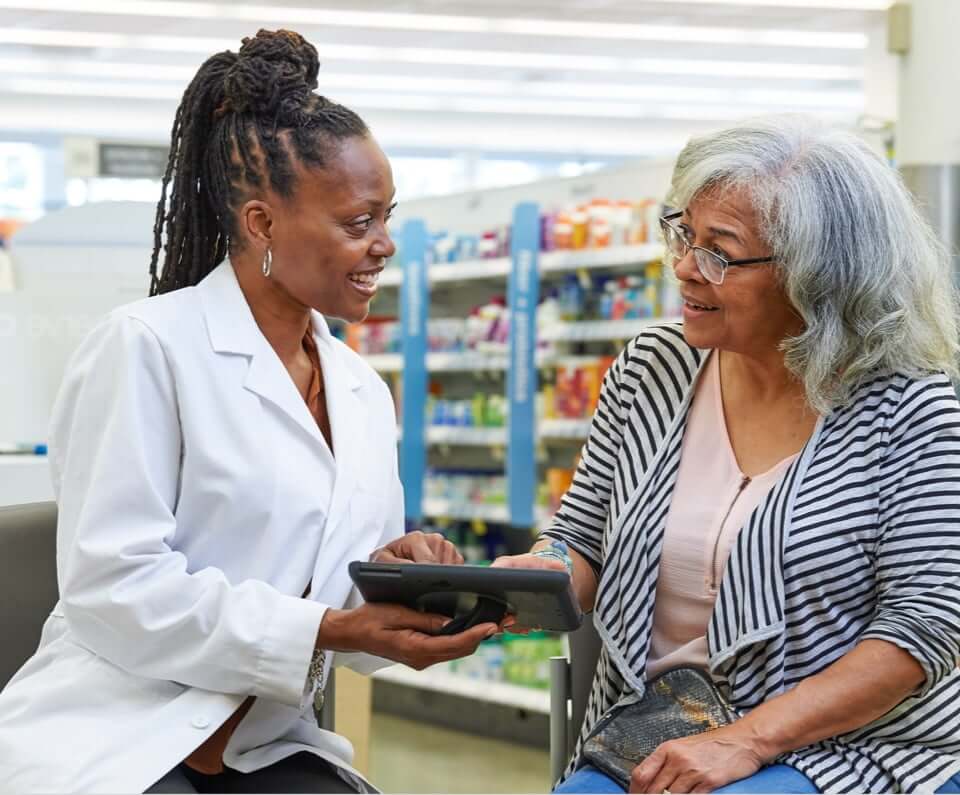

There's no better feeling in a job than helping people live more joyful lives through better health in the communities you serve. And that’s why a career at Walgreens feels so good. With plenty of learning and growth opportunities, exciting challenges and talented teams, you’ll have everything you need to see your future in a whole new way.

Find in-store jobs by location

We have nearly 9,000 stores in all 50 states, D.C., Puerto Rico and the U.S. Virgin Islands, so there are sure to be opportunities close to you.

New opportunities for current team members

Learning and growing is a big part of our culture. So we love it when our people want to explore new possibilities.

Bring your talents to the pharmacy that’s been innovating and evolving for over 120 years.

Make a big difference in neighborhoods and customers’ lives as the smiling face of our brand.

Support our stores by driving the initiatives that propel health and well-being forward.

Join a state-of-the-art distribution system that moves merchandise across the country.

Be the caring voice of our brand when customers and patients have questions.

Micro-fulfillment

Center Jobs

We’re using innovative, robotic technology in a central pharmacy environment, to help ease workload on our store pharmacy teams.